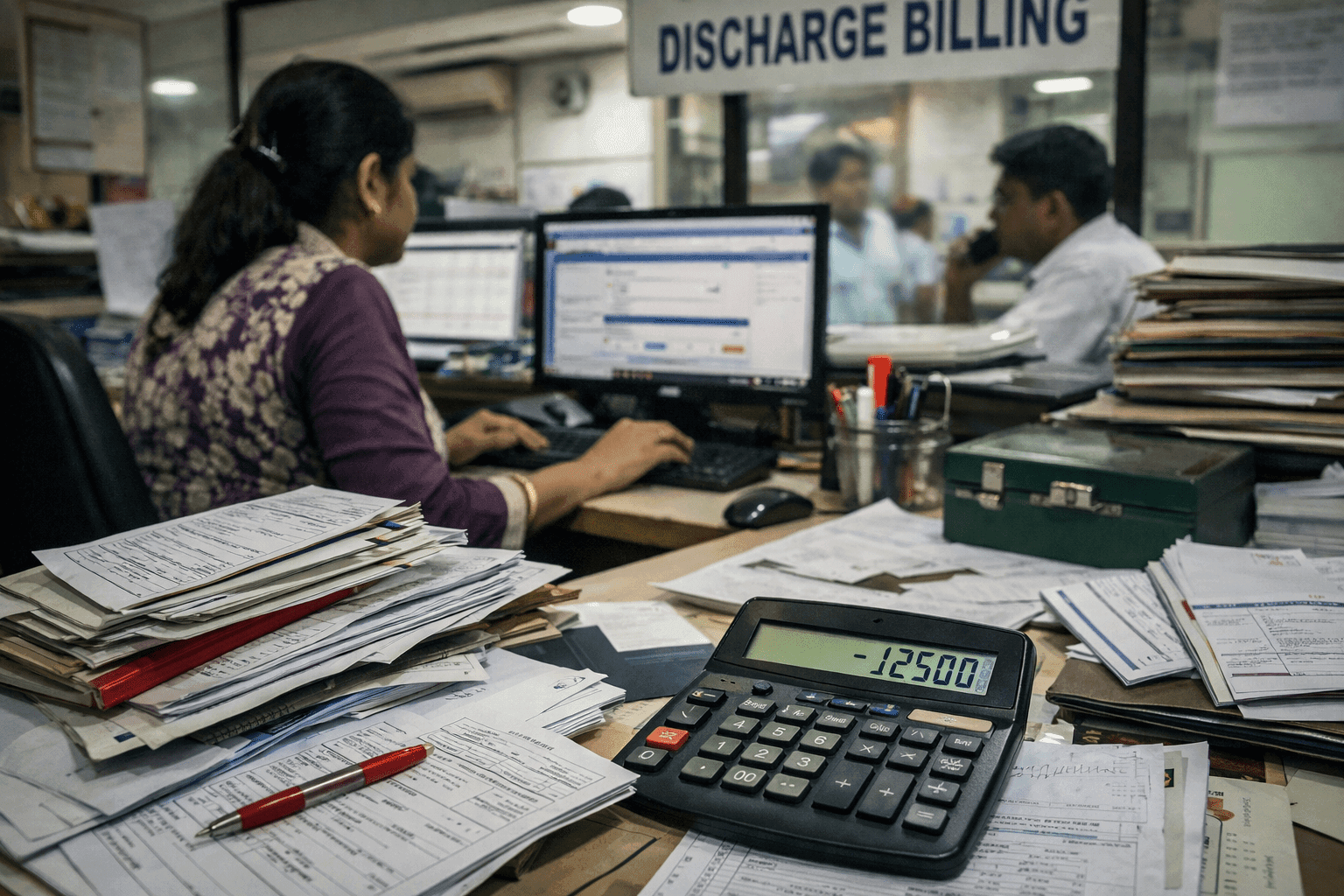

Why Many Hospitals Lose Money Without Realising It

If you ask most hospital owners or administrators whether their hospital has a revenue problem, the answer is usually confident: “No, billing is under control.” OPD numbers are steady, beds are occupied, collections are coming in, and monthly reports look acceptable.

That confidence is often misplaced.

Revenue leakage in hospitals rarely looks like fraud or theft. It hides in routine operations, manual handoffs, and small daily misses that never show up clearly on a P&L. By the time leadership notices something is wrong, margins are already under pressure and nobody can point to a single cause.

This is not a rare problem. It is a structural one.

The Real Problem: Revenue Is Lost Between Care Delivery and Billing

In small and mid-sized Indian hospitals, revenue leakage does not happen because staff are dishonest. It happens because clinical activity and financial capture are disconnected.

Common Real-World Situations That Cause Revenue Leakage

- A procedure is performed, but one consumable never reaches the final bill.

- A consultant visit happens, but the charge slip is delayed or missed.

- Pharmacy issues medicines during emergencies, but reconciliation happens days later.

- Lab tests are ordered verbally or over WhatsApp, bypassing formal billing.

- Discounts are given at the billing desk without clear approval or documentation.

Each instance looks minor. Collectively, they add up.

The core issue is this: most hospitals still rely on manual or semi-manual charge capture, spread across departments that do not share a single, real-time system. Nursing, pharmacy, lab, OT, and billing work hard but not always in sync.

This persists because leadership often assumes:

- “Experienced billing staff will catch errors.”

- “Monthly reconciliation is enough.”

- “Some leakage is unavoidable.”

It isn’t.

The Operational and Financial Impact: Ground Reality

Revenue leakage hits hospitals in ways that are not immediately obvious:

Financial Impact of Hospital Revenue Leakage

- Missed charges directly reduce cash flow.

- Discounts and write-offs quietly erode margins.

- GST calculations become inconsistent when billing data is incomplete.

- Profitability appears weaker despite stable patient volumes.

In many hospitals, leakage is discovered only during:

- Internal audits

- External financial reviews

- TPA disputes

- Tax scrutiny

By then, recovery is impossible.

Operational Impact on Hospital Teams

- Billing teams spend time fixing past mistakes instead of closing bills cleanly.

- Discharge is delayed due to last-minute reconciliations.

- Department heads argue over “who missed what.”

- Staff morale drops when errors are blamed but systems are weak.

Patient Experience Impact

- Patients face surprise charges or confusing bills.

- Disputes at discharge damage trust even when care quality was good.

- TPA patients experience longer turnaround times.

Revenue leakage is not just a finance problem. It is an end-to-end operational failure.

Common Revenue Leakage Mistakes Hospitals Keep Making

Despite years of experience, many hospitals repeat the same errors:

- Treating billing as the control point

By the time a bill is prepared, leakage has already happened. Billing can only work with what it receives. - Relying on manual charge slips and registers

Paper slips get lost, delayed, or filled incorrectly especially during busy shifts. - Allowing departments to work in silos

Pharmacy, lab, OT, and nursing often track activity independently, with reconciliation left for later. - Reconciling monthly instead of daily

Errors caught after 30 days are rarely recoverable. - Ignoring audit trails

When discounts or overrides lack traceability, leakage becomes invisible.

These are not staffing problems. They are system design problems.

What Actually Works in Hospitals That Control Revenue Leakage

Hospitals that control revenue leakage don’t rely on heroic staff effort. They redesign how work flows.

What they do differently:

- Charge capture happens at the point of care, not later at billing.

- Every order,procedure, lab test, medicine must be formally recorded before execution.

- Departments cannot bypass the system during “busy hours.”

- Daily reconciliation becomes routine, not an exception.

- Financial visibility is shared with operational heads, not just accounts.

Most importantly, these hospitals stop treating revenue control as a back-office activity. They make it part of clinical operations without adding friction.

Where a Modern HMS Helps Control Revenue Leakage

Technology does not fix discipline problems. But it removes the excuses that allow leakage to continue.

In hospitals where revenue control improves, the HMS enables:

- Automatic linkage between clinical orders and billing

- Real-time visibility of charges across departments

- Role-based access so discounts and overrides are controlled

- Audit logs that show who did what, and when

- Daily revenue dashboards instead of end-of-month surprises

This is not about “advanced features.” It is about closing the gap between care delivered and care billed consistently, every day.

When systems enforce the workflow, staff stop carrying the burden manually.

A Practical Self-Check for Hospital Leadership

If you want to assess your own hospital honestly, ask these questions:

- Can you confidently say every service delivered yesterday was billed?

- How many charge corrections happen at discharge?

- Are pharmacy and lab revenues fully reconciled daily?

- Can you trace every discount to an approved decision?

- Would you be comfortable explaining your billing process during an audit?

If answering these feels uncomfortable, revenue leakage is already happening.

Final Thought: Revenue Leakage Is a Visibility Problem

Revenue leakage is not about mistrusting staff. It is about accepting that manual systems fail quietly. Hospitals that survive increasing cost pressure are not those with more patients but those with tighter operational control.

The real question is not whether leakage exists, but how visible it is to you today.

If you were audited tomorrow, how confident are you that your hospital’s revenue truly reflects the care you deliver?