The boom of online retail reshaped entire industries, but e-commerce in 2025 looks very different. Businesses now face three permanent pain points: rising costs, escalating customization demands, and stubborn data silos. Small merchants and global retailers alike must weigh trade-offs that were invisible five years ago: move fast with hosted SaaS and accept limits, or invest heavily for control and shoulder the upkeep.

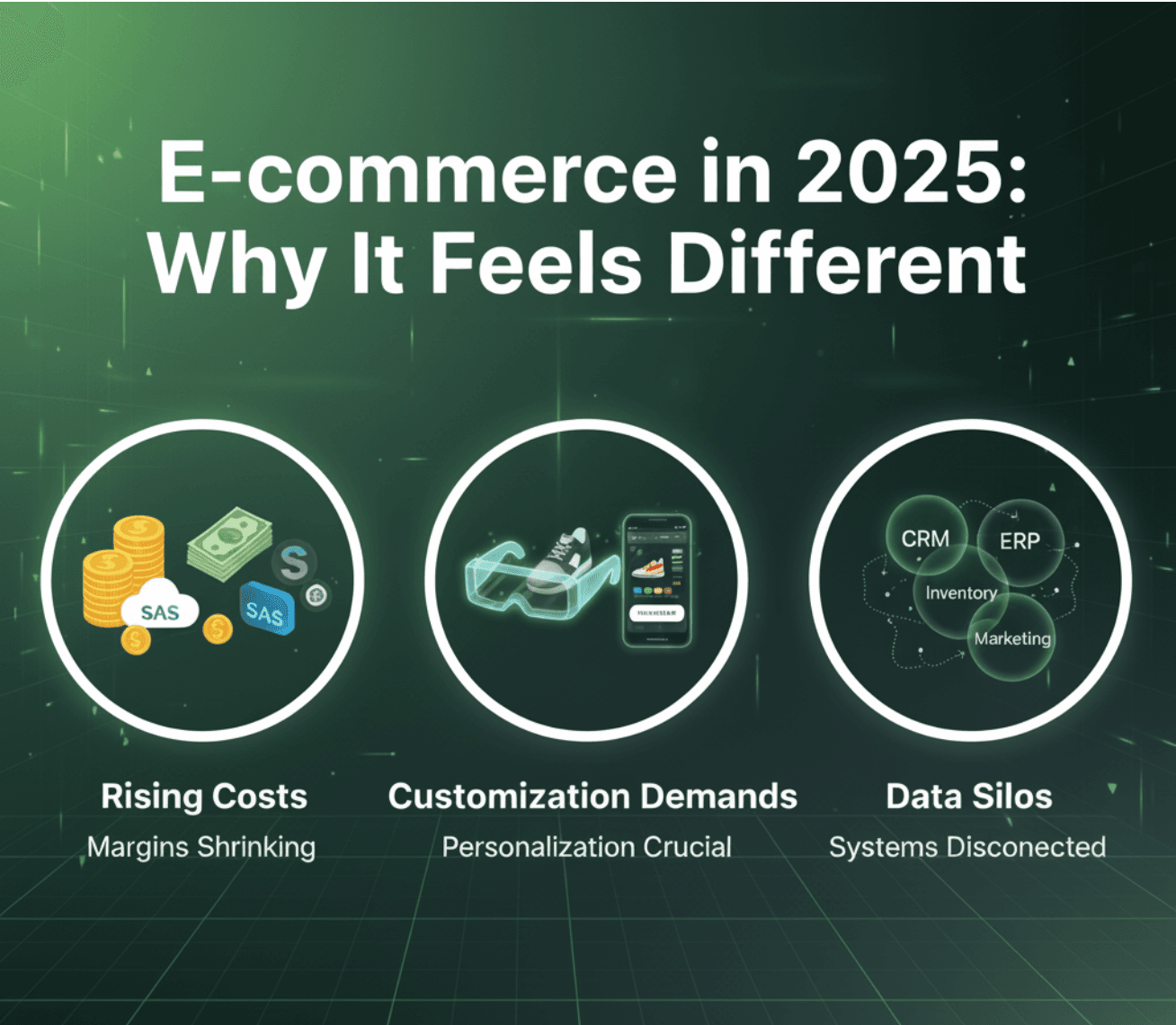

Why E-commerce in 2025 Feels Different

Three forces converge:

Costs are more visible. Subscription fees, gateway/transaction charges, app ecosystems, and integration bills compound rapidly. The cheapest monthly plan on paper can be the most expensive in practice.

Customers expect bespoke experiences. Brands must deliver personalized journeys (AR try-ons, configurators, fast mobile checkout) or risk becoming a generic commodity.

Data still lives in fragments. Order systems, ERPs, CRMs, inventory, and analytics often don’t talk. The result: wrong stock counts, broken loyalty programs, and poor personalization.

If platform choice felt like a product decision five years ago, it’s now a strategic one that shapes margins, agility, and customer trust.

Platform Trade-offs in E-commerce 2025

Shopify (Plus for scale)

Strengths: Speed to market, strong app ecosystem, low up-front friction.

Trade-offs: Less backend control; plugin proliferation can inflate TCO; heavy reliance on third-party apps.

Who should consider it: D2C fashion, small electronics brands, fast pilots.

Adobe Commerce / Magento

Strengths: Open codebase, deep B2B features, unlimited customization.

Trade-offs: Higher dev & maintenance costs; longer time to market.

Who should consider it: Manufacturers with complex SKUs, large catalogs, or advanced B2B requirements.

Salesforce Commerce Cloud

Strengths: Enterprise SaaS, tight CRM & marketing integration, strong omnichannel features.

Trade-offs: License costs and vendor lock-in potential; customizations require specialist partners.

Who should consider it: Large retailers with global operations and Salesforce investments.

Playbook for Merchants: Winning in E-commerce in 2025

Below are concrete, prioritized actions. Follow these in sequence — you’ll get better returns and avoid wasted engineering.

For Small Businesses (lean, fast, <100 employees)

Define 3 core business objectives (e.g., increase AOV, reduce returns, improve shipping speed).

Choose the simplest platform that delivers them. If goals are fast launch + low maintenance: start Shopify.

Limit apps to 3–5 critical ones. Each app adds cost and upgrade risk.

Integrate payments & local rails (UPI in India, PayNow/GrabPay in Singapore, local wallets in the UK) so checkout friction is minimal.

Measure weekly: conversion rate, AOV, repeat purchase rate. Target: conversion ≥1.5% (initial) and 20–30% repeat rate within 12 months.

For Enterprises (scale, compliance, multi-channel)

Map your data flows: list systems that hold orders, inventory, customer records, and pricing.

Adopt an integration layer (iPaaS) early — stop building point-to-point middleware. Prioritize order & inventory sync.

Design for composability: use headless frontends for marketing agility, but keep commerce logic centralized.

Govern customization: adopt a standard for “config vs. code” — features that are unique and revenue-critical get custom code; everything else uses configurable flows.

KPIs to track: inventory accuracy ≥99%, order sync latency <5 minutes, omnichannel revenue % of total, and time to launch new campaign <2 weeks.

Industry KPIs to Benchmark E-Commerce in 2025

Manufacturing

Priority: B2B quoting, configurable SKUs, deep integrations with ERP.

KPI targets: Quote→Order conversion ≥20%, order accuracy 99%, integration downtime 0.1% monthly.

Education

Priority: Accessibility, data privacy, subscription management for micro-learning.

KPI targets: Subscription churn <6% quarterly, WCAG accessibility audit pass, secure student data retention policy enforced.

Fashion

Priority: Visual product experiences, returns management, sustainability signals.

KPI targets: AOV lift from personalization +10–25%, return rate <20% (target depends on category), repeat purchase rate 25–35%.

Electronics

Priority: Rich specs, configurators, warranty & service flows.

KPI targets: Cart conversion on product configurators ≥2x baseline, warranty attachment rate 10–20%.

Tactical integrations that solve data silos

Orders → ERP: automate creation of orders and update inventory in real time. Aim for sub-5-minute sync.

E-commerce → CRM/CDP: unify customer events (views, purchases, returns) into a single profile for personalization.

Fulfillment orchestration: route orders to the nearest fulfillment node; track fulfillment exceptions and measure % delivered on time.

Analytics layer: central warehouse or virtualization for reporting; enforce strong naming and governance.

Target measurable improvements after integration: manual reconciliation time ↓ ≥80%, stockouts due to mis-sync ↓ ≥90%.

Managing customization without blowing up technical debt

Small businesses: prefer low-code features and tested marketplace apps. Prototype new experiences with A/B tests before committing code.

Enterprises: adopt “composable” microservices for business capabilities (search, checkout, promotions) and expose them via stable APIs.

Always version & test: deploy automated tests for customer-facing flows and run regression tests for platform & third-party updates.

Measure: % of features delivered via configuration vs. custom code; target >60% configuration.

Ethical & regulatory checklist (must-do)

Privacy: explicit consent flows; simple data-access and deletion process.

Transparency: clear personalization disclosures and opt-out options.

Accessibility: WCAG compliance checks pre-release.

Sustainability: track carbon per order or packaging materials where relevant.

KPIs: privacy compliance audit pass, accessibility audit pass, percentage of customers able to opt out.

Quick decision matrix (1-page)

Need speed/low IT budget → Shopify.

Need extreme customization & B2B features → Adobe Commerce (Magento).

Need CRM & omnichannel at enterprise scale → Salesforce Commerce Cloud.

If your needs cross buckets, adopt a hybrid strategy: headless front-end on Shopify or SFCC with an ERP/OMS consolidated via an iPaaS.

3 bold predictions for the next 24 months

Composable commerce becomes default for new enterprise projects — rapid marketing experiments will outcompete monolithic upgrades.

Regulators tighten cross-border data rules, pushing more regional data controls and increasing integration complexity for global sellers.

AI personalization will be required, not optional — but ethical governance and consent mechanisms will determine winners.

Final, immediate checklist (first 90 days)

Run a TCO exercise: list monthly & annual platform costs.

Audit customer data locations and prioritize order & inventory sync.

Lock down 3 KPIs for your next quarter and instrument them with analytics.

Prototype one personalization test (e.g., abandoned cart + dynamic coupon) and measure ROI.